Stbentoak

Full Access Member

- Joined

- Jul 20, 2020

- Posts

- 1,660

- Reaction score

- 1,894

A major source affected is some of the palladium and other materials for Catalytic Converters is a good example.

The other even more ironic examole….. stay with me….

Neon….I said stay with me…….Neon is one of the major gases used in the production of laser welds of chips to circuit boards……the following is the irony.

Already a global Chip short…..the neon used for the assembly of some remaking chips to laser weld to circuit boards is in jeopardy……. That is prefect irony.

Again us plants nay not see any immediate impact but sometching to monitor.

. I brought all this up a month ago when the war started. The two major components of chips come from Ukraine or Russia. It doesn’t matter what auto makers think about chips, it’s what chip makers think about chips, who will pay the most for them, who needs them the worst, and what strategic industries will demand that their chip needs to be fulfilled before things like cars and Xbox’s….Having new chip factories doesn’t mean a thing if they can’t get raw materials. If Ukraine is laid to waste, it will be years and years before they can get back up to speed and get their infrastructure put together. It is truly tragic what is happening to the people over there, but it is equally as tragic as they are destroying infrastructure that will take many many years to rebuild….. no infrastructure….no factories, no jobs, no homes, and who’s going to pay for all of this? Russia? ……I doubt it.

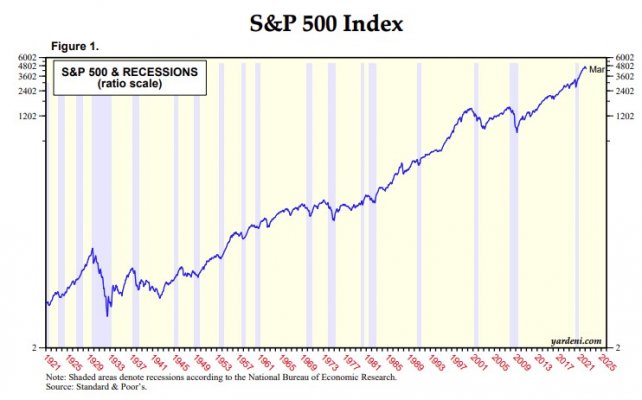

Best place to be financially? Debt free please….and yes I’m a Boomer….

Last edited: