Wolfbraid

Full Access Member

When you retired , you would have nearly $74,000 to pay cash on a Tahoe or even a Denali..

When I retire a New Tahoe or Denali will probably cost $200,000, Escalades are already creeping up on $100k

Disclaimer: Links on this page pointing to Amazon, eBay and other sites may include affiliate code. If you click them and make a purchase, we may earn a small commission.

When you retired , you would have nearly $74,000 to pay cash on a Tahoe or even a Denali..

ya the forever car.....lolWhen I retire a New Tahoe or Denali will probably cost $200,000, Escalades are already creeping up on $100k

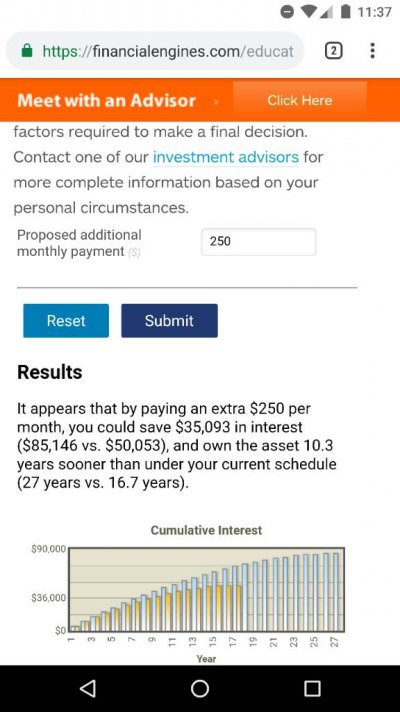

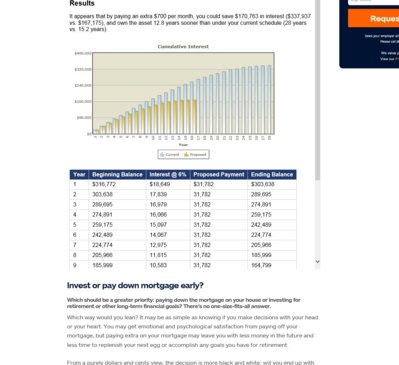

I would say probably not not unless your interest rate is super low, me paying double payments has reduced my loan from 5yrs to 2yrs or less, I was watching a video a guy did (on homeloans) where you make a $10k payment on the principal every year and it made a 30 year loan a 10-12 year loan, it sounded a little tricky because he was talking about using a line of credit to do it if you had a fixed income but I don't know it kind of made sense. if I had only been making the minimum payment I would be paying almost $7k more in interest. so I think I am way far ahead of the game, I could have saved myself more if I had really tried to pay more principal at the very beginning of the loan, but now I know.Just seen this and have thought about this as well, but for my mortgage. I was reading an article about it and they said it's better to invest that money elsewhere since the interest you will save will be minimal compared to the potential profit you can make.

I've always been told that if you make one extra mortgage payment a year, it will take 6-8 years off your mortgage and save you a bunch on interest. But after reading that article, it basically says, if you have a $1000 payment, and make an additional payment each month, the money you are putting towards the principal will only save you $xx.xx dollars. But if you take that extra money and invest it elsewhere, it can make you more than the $xx.xx dollars you saved on Interest. Does that make sense?

I'm so torn.....

exactly, I ran it paying an extra $700 a month and it cuts the loan time in half and saves 170,000 in interest, and that's at a rather high 6%I found this and it seems that the old saying rings more true to what I would rather do than invest.

https://financialengines.com/educat...lculator-should-i-pay-off-mortgage-or-invest/

Good lord, what the hell do you do for a living and can I get a job with you....extra $500 a month on the vehicle and an extra $700 on the mortgage. Sheesh buddy, how many knee pads do I need to buy to get that kinda money.....hahahaexactly, I ran it paying an extra $700 a month and it cuts the loan time in half and saves 170,000 in interest, and that's at a rather high 6%

View attachment 208138

NO, LOL I was just putting in a imaginary number to show how much a person could save I lost my house a few years back unfortunately looking to probably buy again in a couple more years, I had bought a house with a "devil women" 1/2 & 1/2, then our relationship didn't work out and she didn't make diddly squat for money I moved out and she was supposed to move out so we could rent it and keep it just business, but she couldn't even afford to move out so I was paying the mortgage and rent on another house and after about 2 1/2 years the money just ran out, lost 100k on that freaking house, next time its going in my name only IDGAF if she's an angel from heaven once you buy together your stuck and just hope it works out, lesson from the now wiser.Good lord, what the hell do you do for a living and can I get a job with you....extra $500 a month on the vehicle and an extra $700 on the mortgage. Sheesh buddy, how many knee pads do I need to buy to get that kinda money.....hahaha