There is a lot of money out there right now. All my financial friends agree. Inflation means nothing to these folks, they are flush with cash. Those who are worried about paying an extra $50/week for groceries are not buying loaded Tahoe's and Yukon's at $5-10K over MSRP. Same thing with Bronco's and EV's. Some folks are paying $200K to get a new Hummer! I don't see an end to this until we actually land in a recession.

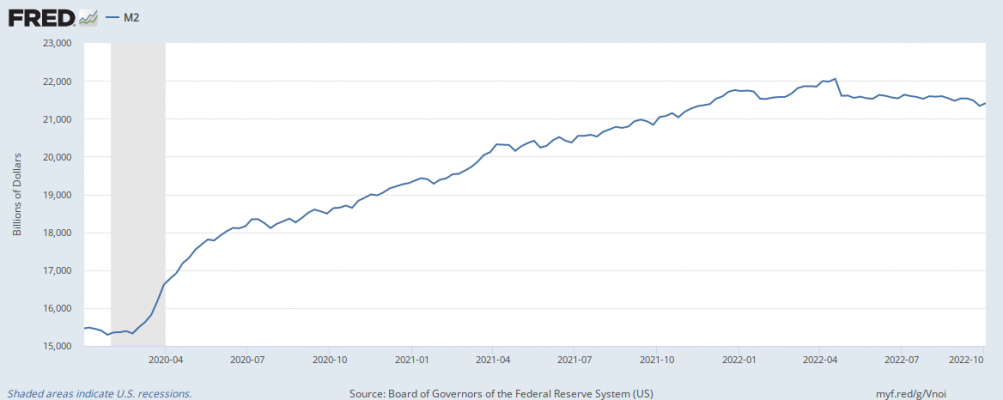

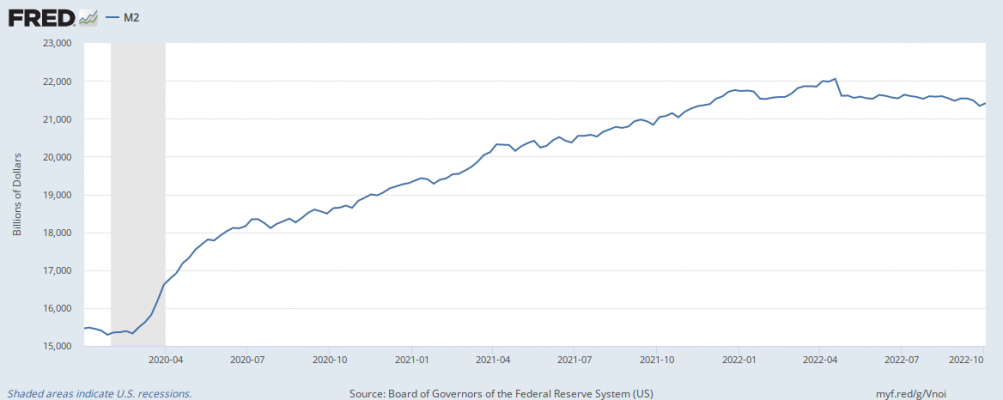

Sure there is, but that trend is slowly reversing (at the moment):

I agree. People buying 60k+ suvs are not worried about inflation. Now it will kill some demand as discretionary spending tightens but nothing crazy.

So I think we need to be more precise because I think we're talking about a bunch of different groups of consumers:

1. Consumers that already bought SUVs - already paid cash or locked in a fixed rate auto loan almost like someone who already has a 15 or 30 year fixed rate mortgage when interest rates were low

2. Prospective cash buyers - not as affected by inflation due to nature of a cash purchase

3. Prospective buyers that require financing - interest rate sensitive

4. No longer a prospective buyer - needs have changed or prices have increased to a point where they seek alternatives

#1 - My suspicion is that a sizable % of the people on this forum are already in this group so they may not be speaking from the perspective of the other groups. For someone that's settled and not looking to purchase a home, inflation has little bearing on a fixed rate 15-30 year mortgage.

#2 - The group that can drop $50-90k in cash for a vehicle is not common. I think they would not be affected by inflation as much - but remember, about 50% of sales in this group are finance purchases and that will increase as the MSRP of these vehicles increase since wages are not keeping pace with inflation.

#3 - This group is definitely going to be affected by interest rate increases and they're going to hold back from purchasing because of economic uncertainty. If you didn't have 50+k in cash to purchase the vehicle outright, you may give pause when you're potentially on the hook for the remaining payments on this vehicle when the economy takes a shit and you're unemployed.

#4 - I think this is the most interesting group because one would initially think that this group has determined that they would not be able to or want to purchase a full size SUV at the moment. But I would argue that your #2 buyer could also be your #4 buyer. The 1/2 ton full size SUV is what I would consider one of the most in demand segments. In my case, I was originally looking at purchasing a 1/2 ton full size SUV because it could carry people (if needed) or tow a track car to and from racetracks on the East Coast. But I'm re-considering purchasing a 1/2 ton pickup in 2024 instead since that market is more of a buyer's market at the moment. I would then push off my 1/2 ton full size SUV purchase until 2026-2028 when supply recovers more - heck perhaps by then, I don't need the towing or payload capability of a 1/2 ton full size SUV and a 3 row unibody SUV like a Jeep Grand Cherokee L would suffice in addition to my pickup, track car, and commuter car.

The point is, I think people with 60+k cash to purchase these vehicles are also going to figure out how to make it work for them over a longer time horizon and adjust how they are going to life cycle their fleet to get the most bang for their buck.